The smart Trick of Wealth Management That Nobody is Discussing

Wiki Article

9 Simple Techniques For Wealth Management

Table of ContentsHow Wealth Management can Save You Time, Stress, and Money.The 3-Minute Rule for Wealth ManagementThe smart Trick of Wealth Management That Nobody is DiscussingWealth Management - QuestionsSome Known Details About Wealth Management

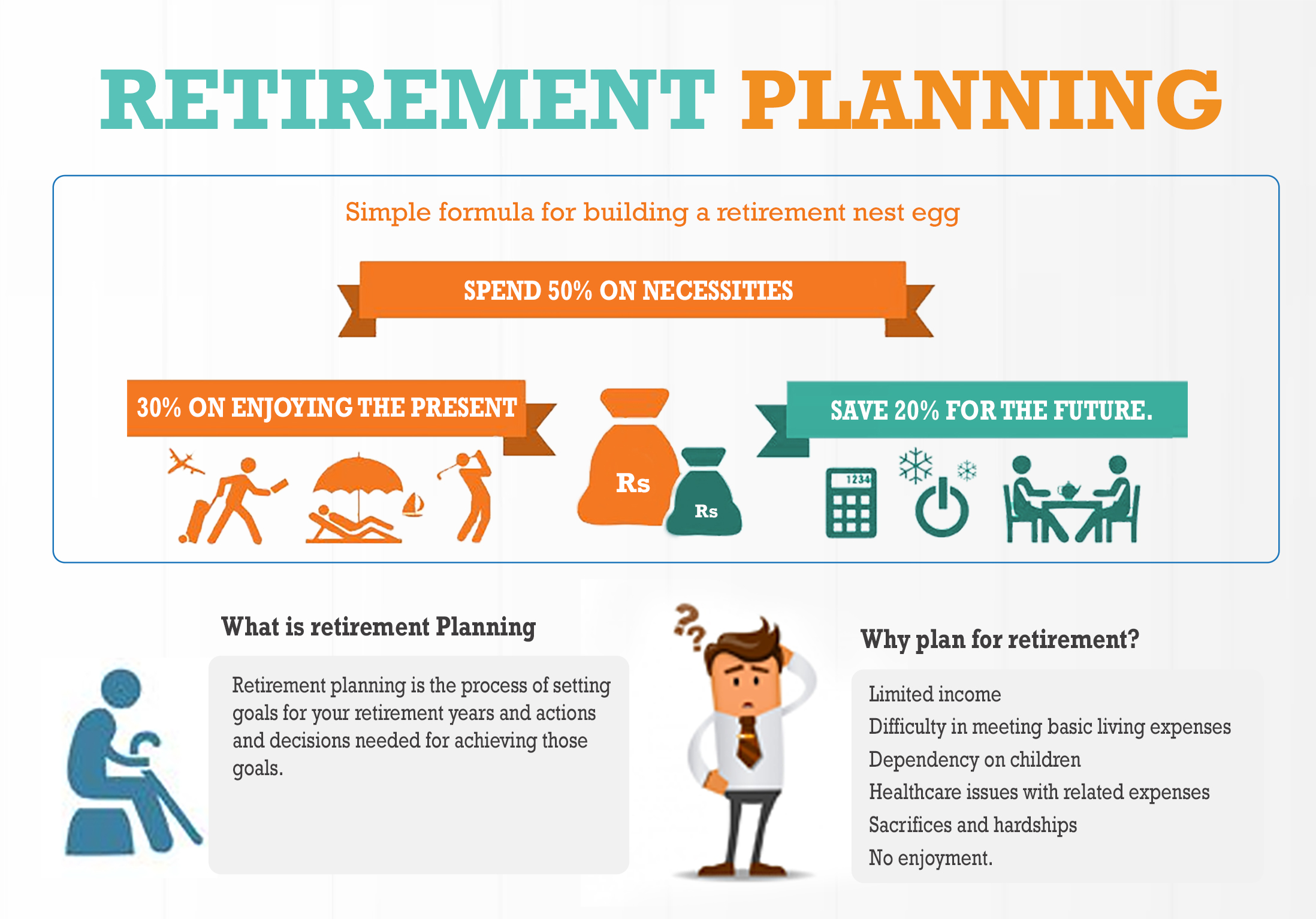

The non-financial facets include way of life choices such as exactly how to hang out in retired life, where to live, as well as when to give up functioning entirely, among other things. A holistic approach to retirement preparation thinks about all these locations. The focus that a person places on retired life preparation changes at different stages of life.

Others say most retirees aren't saving anywhere near sufficient to fulfill those benchmarks as well as should readjust their lifestyle to reside on what they have. While the quantity of money you'll intend to have in your nest egg is very important, it's also a great idea to take into consideration all of your expenses.

The Basic Principles Of Wealth Management

As well as given that you'll have a lot more downtime on your hands, you might likewise intend to consider the cost of home entertainment and travel. While it might be difficult to come up with concrete numbers, make sure to come up with a reasonable price quote so there are no shocks in the future.

No matter of where you remain in life, there are several vital actions that use to almost every person during their retired life planning. The following are a few of the most common: Develop a plan. This includes deciding when you intend to start saving, when you intend to retire, and also just how much you would love to save for your utmost objective.

Examine on your investments every so often as well as make regular changes. It's always a great concept to make any type of changes whenever there's an adjustment in your lifestyle and when you enter a different stage in click here for more your life. Retirement accounts can be found in numerous sizes and shapes. The rules and regulations for each may be different.

You can as well as ought to contribute more than the amount that will gain the company match. Actually, some specialists this content suggest upwards of 10%. For the 2023 tax year, participants under age 50 can contribute as much as $22,500 of their earnings to a 401( k) or 403( b) (up from $20,500 for 2022), some of which might be in addition matched by a company. wealth management.

The Single Strategy To Use For Wealth Management

The typical private retired life account (IRA) allows you deposit pre-tax bucks. This suggests that the cash you save is deducted from your earnings prior to your tax obligations are gotten. Thus, it lowers your gross income and also, therefore, your tax liability. So if you get on the cusp of a greater tax obligation bracket, buying a standard individual retirement account can knock you down to a lower one.When it comes time to take circulations from the account, you are subject to your typical tax obligation price at that time. Maintain in mind, though, that the money grows on a tax-deferred basis.

Roth IRAs have some limitations. The payment limit for either individual retirement account (Roth or typical) is $6,500 a year, or $7,500 if you are over age 50. Still, a Roth has some income limits: A single filer can add the sum total just if they make $129,000 or less each year, since the 2022 tax year, as well as $138,000 in 2023.

The 7-Minute Rule for Wealth Management

It works the exact same means a 401( k) does, permitting staff members to save like this money instantly with pay-roll deductions with the choice of a company match. This quantity is covered at 3% of an employee's yearly salary.Catch-up contributions of $3,500 enable employees 50 or older to bump that limitation up to $19,000. When you established up a retirement account, the inquiry comes to be how to guide the funds.

Below are some guidelines for successful retired life planning at various stages of your life. Those embarking on adult life may not have a whole lot of money free to invest, however they do have time to allow investments mature, which is a crucial as well as important piece of retired life financial savings. This is since of the concept of compounding.

Also if you can just deposit $50 a month, it will be worth three times extra if you invest it at age 25 than if you wait to begin investing till age 45, many thanks to the pleasures of intensifying. You could be able to spend more money in the future, but you'll never have the ability to offset any type of lost time.

The Ultimate Guide To Wealth Management

Nonetheless, it's crucial to continue conserving at this stage of retired life preparation. The combination of gaining more money as well as the moment you still have to spend as well as gain passion makes these years a few of the very best for hostile cost savings. People at this phase of retirement preparation should remain to take benefit of any kind of 401( k) matching programs that their companies use.Report this wiki page